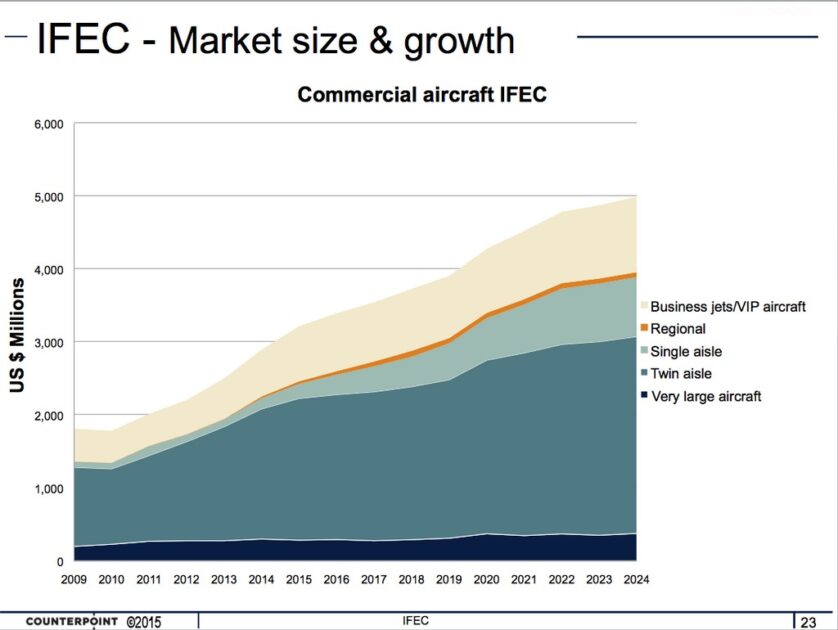

The inflight entertainment & connectivity (IFEC) market is the fastest evolving of all the aircraft interiors segments. As a whole the aircraft interiors market (including business aviation and bizjets) will grow at a compound annual rate of 5percent

annually over the next ten years – far higher than other aerospace sectors according to UK-based consultancy Counterpoint (www.cpmil.com) in its latest report Aircraft Interiors 2015.

IFEC is growing at an above average rate of all aircraft interiors (AI) segments at 5.6percent annually. Counterpoint director Richard Apps says, ‘The future configuration of aircraft IFE and connectivity technologies is in a state of flux. This is the fastest evolving sector of the interiors market.’

Counterpoint estimates the global IFEC market was worth $2.9bn in 2014 compared to a total global AI market of $13.5bn. (The IFEC value excludes content and applies to the equipment in the cabin itself excluding the externals such as the radomes and antenna, as well as the on-board satcom terminals.)

By 2024 IFEC is likely to be worth $5bn and the AI market as a whole more than $20bn. Seats account for a dominant marketshare growing at 4.9percent per annum. He says, ‘In AI the key driver is competition for passengers between airlines and we do not see this changing.’

In terms of aircraft types, twin aisle is seeing the largest marketshare in IFEC investment with no sign of a let-up. It occupies the lion’s share of the $2.9 billion at around $2.2bn currently and will account for around $3bn in ten years’ time.

However other aircraft types particularly commercial single aisle will increase their marketshare substantially.

Apps says, ‘IFEC hasn’t traditionally been on single aisle but this is changing rapidly. Passengers are increasingly expecting to connect to the Internet even for short haul flights. To a lesser extent passengers are also expecting IFE.’